China’s Green Electricity Certificates: What Companies Need to Know

Market Insights | Jan/16/2026

Green Electricity Certificates, or GECs, are China’s official energy attribute certificates for renewable electricity generated in mainland China. They act as the formal proof that renewable power has been generated and its environmental attributes claimed by the end user. The system was first introduced as a pilot in 2017, initially focused on wind and solar projects. Since then, it has grown into a nationwide scheme that now covers almost all renewable energy technologies, including wind, solar, hydropower, biomass, and geothermal generation.

Each GEC represents 1 megawatt-hour of renewable electricity delivered to the grid and comes with a unique electronic identifier. This makes GECs the only nationally recognized instrument for verifying renewable electricity generation and consumption in China. Certificates are issued and tracked through a centralized online system overseen by the National Energy Administration, linking every certificate to verified production data.

In practical terms, GECs function much like renewable energy certificates used in other markets. They allow companies to credibly claim the environmental value of renewable electricity, even when physical power flows cannot be directly traced. For sustainability teams operating in or sourcing from China, GECs form the core mechanism for substantiating renewable electricity use within the country’s regulated framework.

GECs Market Specifics

China’s GEC market has shifted quickly from a narrow pilot into a national trading system. While participation remains voluntary today, policy direction increasingly points toward wider expectations around green power use, especially for energy-intensive sectors. As a result, many companies are starting to treat GEC procurement as a forward-looking compliance and credibility measure rather than a purely optional one.

How GECs are traded

GECs are traded either as standalone certificates or bundled with physical green electricity sales. This structure allows companies to choose between contractual green power purchases and attribute-only claims, depending on operational needs. All transactions are recorded within centralized systems to keep issuance, ownership, and retirement aligned.

Who can buy and use GECs

Only companies incorporated in mainland China, including foreign-invested enterprises, are allowed to purchase GECs directly. Overseas parent companies cannot buy certificates themselves and must rely on their Chinese subsidiaries to procure and retire GECs on their behalf. This keeps claims tied to electricity consumption within China’s regulatory boundary prevents cross-border double counting of renewable attributes.

Market scale and recent momentum

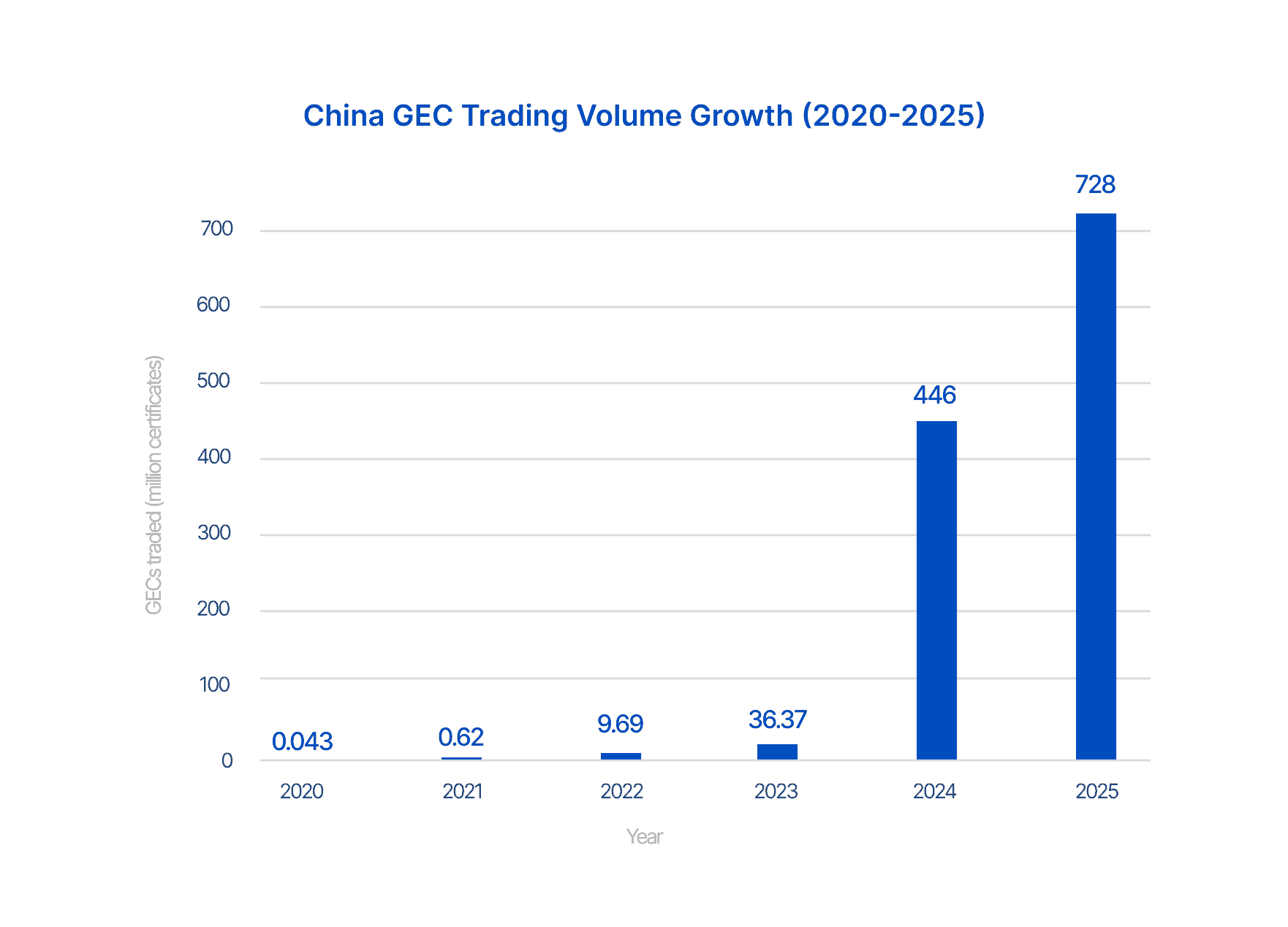

Issuance volumes are enormous, reflecting the scale of China’s renewable build-out, and for several years demand lagged far behind supply. That dynamic has started to change. Trading volumes surged in 2024, participation expanded rapidly, and procurement activity concentrated among large electricity consumers, particularly in the industrial sector. In 2025 alone, more than 700 million GECs were transacted, over 60% higher than the volume recorded in 2024.

What is new in 2026

Historically, GECs were issued with a defined validity period of up to 24 months from the date of generation. However, from electricity consumption in 2026 onward, China is transitioning toward a redemption-based framework that places greater emphasis on matching certificate vintage with the year of electricity consumption.

Under this approach, the ability to redeem a GEC becomes the determining factor for whether it can be used to support renewable electricity claims. As a result, same-year matching between electricity consumption and GEC vintage is becoming central to both domestic reporting and international Scope 2 claims tied to China-based operations.

Who is driving demand

Manufacturing companies now account for the majority of GEC purchases, signaling that renewable electricity claims are becoming part of mainstream industrial sustainability strategies. Trading activity is strongest in economically developed regions, including the Yangtze River Delta, the Greater Bay Area, and the Beijing–Tianjin–Hebei cluster, where corporate climate targets, export exposure, and disclosure pressure tend to be highest.

Pricing and policy context

For several years, GEC pricing reflected the early stage of the market. Oversupply and voluntary participation kept prices disconnected from the broader value companies associate with renewable electricity claims. As corporate demand and policy attention increased, that imbalance became harder to ignore, particularly as GECs began playing a more visible role in national decarbonization efforts.

A clear policy shift emerged in 2025. Authorities signaled an intention to support healthier price formation and more consistent trading practices, alongside tighter oversight of issuance and retirement. Rather than introducing fixed price controls, regulators have focused on improving market mechanisms and demand-side participation, allowing prices to adjust as procurement becomes more widespread.

Policy is now acting on both supply and demand. Supply mechanisms are being refined, while demand is being encouraged through incentives and gradually strengthened renewable consumption expectations. In some provinces, energy-intensive industries are already required to source a significant share of electricity from renewable generation, using direct green power procurement and GECs as the primary tools.

Sector-specific requirements are already in place. Aluminum smelters in Yunnan, Qinghai, and Sichuan, for example, are required to source at least 70 percent of their electricity from renewables, leveraging regional hydropower resources. Similarly, in March 2025, the government issued guidelines mandating that by 2030, key energy-intensive sectors (steel, non-ferrous metals, cement, petrochemicals, chemicals, and data centers) must use enough green power that their renewable share meets or exceeds the national average.

Taken together, these shifts point to a market that is maturing quickly. GECs are moving from a low-engagement, surplus-heavy instrument toward a mainstream component of corporate electricity strategies in China. For companies, this means pricing, availability, and procurement decisions are becoming more dynamic, increasing the importance of timing, procurement strategy, and market access rather than treating GECs as a static compliance item.

Why companies buy GECs

At the most basic level, companies buy GECs to credibly claim the use of renewable electricity in China. Retiring a GEC allows a business to associate 1 megawatt-hour of its electricity consumption with verified renewable generation, even when physical power flows are mixed on the grid. For corporate sustainability teams, GECs are the primary mechanism for managing and substantiating Scope 2 electricity emissions in the Chinese market.

Meeting renewable electricity targets

Many companies have public commitments to transition to 100% renewable electricity, often tied to initiatives such as RE100. In China, where on-site generation and long-term green power contracts are not always feasible, GECs offer a practical pathway to stay on track. Multinational companies can procure GECs through their Chinese subsidiaries and count them toward group-wide renewable electricity targets.

Managing and reporting Scope 2 emissions

GECs carry the environmental attributes of renewable electricity and are used to account for Scope 2 emissions under market-based accounting approaches. By retiring certificates that match electricity consumption, companies can report lower or zero Scope 2 emissions for that power use.

Responding to policy signals and emerging requirements

While GEC procurement is still voluntary at the national level, regulatory expectations are becoming clearer. Some provinces already require large electricity consumers to meet renewable usage thresholds, and disclosure rules increasingly expect companies to substantiate renewable electricity claims with formal evidence.

Strengthening ESG positioning and stakeholder trust

Beyond compliance, GEC purchases support broader ESG and reputation goals. Investors, customers, and global supply chain partners increasingly expect companies operating in China to demonstrate tangible progress on renewable electricity use. GECs provide a locally recognized way to show alignment with China’s clean energy transition while remaining consistent with international sustainability frameworks.

Voluntary schemes and international recognition

A major turning point for China’s GEC market has been its growing acceptance within international renewable energy frameworks. In 2025, global initiatives began to formally recognize GECs as credible instruments for renewable electricity claims, reflecting the rapid maturation of China’s certificate system. For multinational companies, this marked an important shift in how renewable electricity sourced in China can be treated within global sustainability strategies.

Recognition by RE100

In 2025, China’s GECs received full recognition from RE100. Earlier conditional treatment was removed following regulatory refinements, including defined validity periods and safeguards against double counting. As a result, GECs can now be used toward RE100 targets for electricity consumed in China without additional qualifications, on equal footing with instruments such as I-REC and European Guarantees of Origin.

Alignment with emissions accounting standards

China’s GEC framework now meets the quality criteria set out by the GHG Protocol for market-based Scope 2 claims. These criteria include exclusive ownership of attributes, timely retirement, geographic alignment, and traceable documentation. Mandatory cancellation and centralized registry tracking place GECs squarely within accepted global accounting practice.

Acceptance across disclosure and target-setting platforms

Because of this alignment, retired GECs are accepted as valid evidence of renewable electricity use by reporting and target-setting bodies such as CDP and the Science Based Targets initiative.

Relevance for emerging disclosure rules

Formal documentation of renewable electricity use is becoming increasingly important. Under expanding ESG disclosure requirements, including the EU’s Corporate Sustainability Reporting Directive and evolving reporting expectations within China, companies are expected to substantiate green power claims with recognized instruments.

What this means for multinational companies

Together, these developments mean that GECs now function as a globally accepted instrument for renewable electricity claims tied to Chinese operations. Whether companies are pursuing RE100 commitments, reporting emissions, or tracking internal renewable targets, GECs provide the credibility and documentation required to integrate China-based electricity use into global sustainability strategies. The growing number of multinational companies procuring GECs reflects how this recognition has translated into real market uptake.

How CnerG Can Help

CnerG supports companies navigating China’s GEC market with practical, market-driven tools designed for corporate buyers.

- Access China GEC supply through a global marketplace that connects buyers with verified, eligible certificates

- Price visibility and market context via live GEC price insights that help teams plan procurement with confidence

- Procurement support across markets, allowing companies to manage China GECs alongside other EACs and carbon instruments in one place

- Documentation and retirement tracking to support ESG reporting, RE100 alignment, and Scope 2 accounting

- Guidance on policy and reporting so sustainability teams understand how GEC purchases fit into global frameworks like RE100, CDP, and SBTi

Get Started With CnerG

Request Demo

Learn how CnerG can help you source Environmental

Commodities with ease.